BTC Price Prediction: Path to $200,000 Amid Market Transformation

#BTC

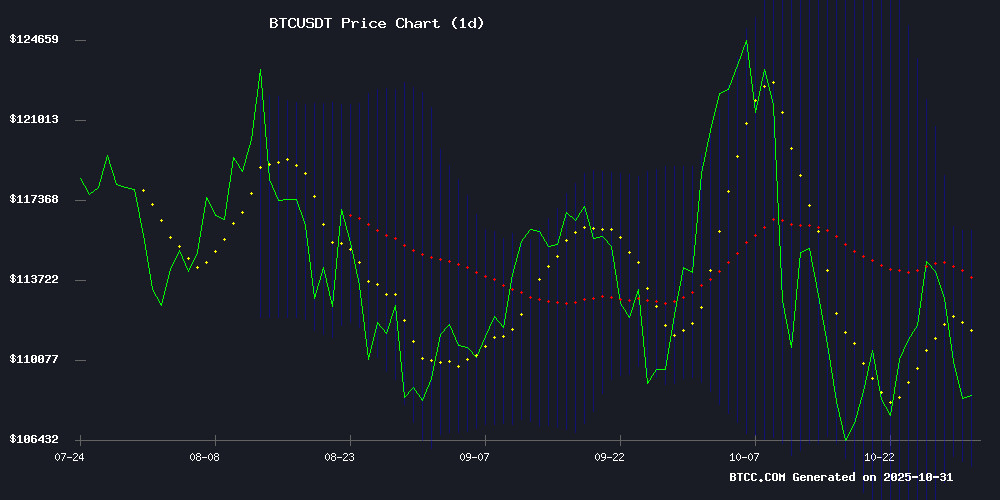

- Technical Consolidation: BTC is trading below the 20-day MA but within Bollinger Bands, suggesting accumulation phase before next significant move

- Institutional Transformation: Growing corporate and institutional adoption provides fundamental support despite short-term volatility

- Macroeconomic Alignment: Bitcoin's positioning in global credit expansion and digital asset infrastructure supports long-term bullish thesis

BTC Price Prediction

Technical Analysis: BTC Trading Below Key Moving Average

Bitcoin is currently trading at $109,284.47, positioned below the 20-day moving average of $110,634.53, indicating potential short-term resistance. The MACD reading of -2,076.10 suggests bearish momentum in the NEAR term. However, BTC remains within the Bollinger Band range of $105,325.14 to $115,943.92, with the current price sitting closer to the middle band, signaling consolidation. According to BTCC financial analyst Mia, 'The technical setup shows BTC is in a consolidation phase after recent corrections. The defense of the $110K level by bulls and the current positioning within Bollinger Bands suggest potential for accumulation before the next move.'

Market Sentiment: Mixed Signals Amid Institutional Transformation

Current market sentiment reflects a complex interplay of factors. Negative headlines about Satoshi Nakamoto's holdings losing $5B and 'Uptober' fading are balanced by positive institutional developments. MicroStrategy's positioning of Bitcoin at the core of global credit expansion and ongoing institutional transformation provide fundamental support. BTCC financial analyst Mia notes, 'While short-term headwinds from Fed policy debates and technical corrections create volatility, the institutional adoption narrative remains strong. The market is digesting mixed signals but the underlying transformation continues.' The defense of $110K by bulls and recovery momentum mentioned in news aligns with technical support levels.

Factors Influencing BTC's Price

Satoshi Nakamoto's Bitcoin Holdings Lose $5B in Market Correction

Bitcoin's enigmatic creator, Satoshi Nakamoto, saw the value of their holdings plummet by nearly $5 billion on October 30 as the cryptocurrency market faced a sharp downturn. The wallets linked to Nakamoto now hold approximately $117 billion worth of BTC, down from a peak of $122 billion earlier this year.

Arkham Intelligence data confirms these wallets—containing roughly 1.1 million BTC, or over 5% of Bitcoin's circulating supply—have remained dormant for 15 years. No transactions were executed during the market turbulence. The loss reflects pure price depreciation rather than any movement of funds.

Nakamoto remains the largest known individual Bitcoin holder despite the valuation drop. The untouched stash continues to symbolize both Bitcoin's origins and its volatility—a digital goldmine frozen in cryptographic time.

Uptober Fades: What is Halting Crypto’s Ascent?

October's anticipated 'Uptober' rally in cryptocurrencies proved fleeting, with Bitcoin experiencing significant volatility before stabilizing at a median level. The market's weakness stems from declining risk appetite among U.S. investors, despite positive developments like the U.S.-China agreement and strong corporate earnings.

On-chain analyst Anıl highlights the critical role of the Coinbase Premium Index, which reflects U.S. demand for Bitcoin. A higher BTC price on Coinbase compared to other exchanges signals strong institutional interest. Without a recovery in U.S. trading volume, sustained price gains remain uncertain.

MicroStrategy Positions Bitcoin at Core of Global Credit Expansion Amid Financial Turnaround

MicroStrategy has pivoted from last year's losses to a $12 billion operating income through the first nine months of 2025, with CEO Phong Le announcing plans to issue bitcoin-backed credit securities in international markets. The firm's $8.6 billion net income marks a dramatic reversal from 2024's negative EPS of $2.71, now standing at $27.71.

The company is methodically eliminating its $8.2 billion convertible debt portfolio ahead of a 2029 target, while raising $20 billion this year across capital markets. Bitcoin's role as collateral for global credit instruments signals institutional maturation—MicroStrategy's treasury now functions as a de facto crypto investment vehicle.

Trump's Cryptocurrency Remarks Fail to Lift Bitcoin Past $112K Amid Mixed Market Signals

Bitcoin's price stalled below $112,000 despite bullish political developments, highlighting the cryptocurrency market's growing detachment from traditional news cycles. Former President Trump's denial of impending military action against Venezuela and praise for China trade agreements failed to ignite the anticipated rally, with altcoins showing only marginal recovery.

The disconnect between geopolitical announcements and crypto price action underscores maturing market dynamics. 'The agreement with China will be long-term,' Trump declared, while Treasury officials simultaneously warned Beijing against weaponizing critical minerals. Such mixed signals from Washington create uncertainty for risk assets.

Friday's Market Movers: Tech and Energy in Focus

Tech stocks dominated Friday's trading session as earnings-driven momentum lifted heavyweights. Apple surged on bullish analyst coverage following robust earnings, while Amazon rode higher price targets post-Q3 results. Nvidia extended its AI-fueled rally with a major South Korean chip deal announcement.

The energy sector lagged as Exxon Mobil stumbled after missing revenue estimates. Meta Platforms dipped slightly as its bond offering for AI funding failed to inspire investors. Meanwhile, Netflix and Warner Bros Discovery gained ground amid buyout speculation.

MicroStrategy bucked the tech trend with shares rising despite a price target cut, demonstrating continued institutional confidence in its Bitcoin-heavy strategy. The divergence between crypto-correlated equities and traditional tech names highlights growing market segmentation.

Bitcoin’s Institutional Transformation Reshapes Market Dynamics

Spot Bitcoin ETFs have fundamentally altered the cryptocurrency's liquidity landscape, shifting vast volumes from retail exchanges to regulated institutional channels. BlackRock's IBIT now commands roughly $80 billion in assets, emblematic of Wall Street's growing embrace of digital assets.

The in-kind creation mechanism underpinning these ETFs introduces operational efficiencies but also creates potential volatility triggers. When large-scale redemptions occur, the underlying Bitcoin movements can cause temporary price dislocations despite the overall market deepening.

Corporate adoption reaches new milestones as treasury strategies like MicroStrategy's accumulate 1% of Bitcoin's total supply. This institutional hoarding reduces circulating float while creating novel correlations between crypto markets and corporate balance sheets.

Bitcoin Bulls Defend $110K as Recovery Gains Momentum

Bitcoin has reclaimed the $110,000 level after a brief sell-off, trading near $109,900 with a 2% daily gain. Market capitalization now exceeds $2.19 trillion, supported by $66 billion in daily volume.

Technical indicators show neutral momentum with RSI at 46, while the MACD hints at potential recovery. Analysts identify $112,340 as the next critical resistance—a breakout could propel BTC toward $115,000-$118,000.

The 50-day moving average continues to serve as a reliable support zone. Market structure remains bullish barring any sustained drop below $110,000, with traders anticipating renewed upside through November.

Fed Policy Debate and Venezuela Tensions Coincide with Bitcoin Stability

Federal Reserve official Logan voiced dissent over recent rate cuts, suggesting further reductions in December would be premature. The Fed's September move already addressed employment risks, leaving limited room for additional easing. Meanwhile, triparty repo rates exceeding the SRF rate have raised operational concerns.

Geopolitical tensions flared as the U.S. reportedly prepared to target Venezuelan military sites, creating market uncertainty. Bitcoin held steady at $109,900 despite altcoin stagnation, demonstrating resilience amid macroeconomic crosscurrents. The cryptocurrency's performance contrasted with traditional markets, which dipped following Powell's dampened expectations for December rate cuts.

Trillion-dollar corporate earnings failed to lift broader sentiment as Bitcoin established a new local low at $110,251. The digital asset's price action reflected investor caution during a week of mixed signals - from hawkish Fed commentary to escalating South American tensions.

Bitcoin Faces Potential Drop to $100K Amid Fed-Induced Market Volatility

Bitcoin's price trajectory has turned turbulent following the latest Federal Open Market Committee (FOMC) meeting, with analysts warning of a possible retreat to the $100,000 support level. The flagship cryptocurrency currently trades at $109,474, reflecting a 0.42% daily decline, while 24-hour trading volume stands at $66.5 billion.

The broader digital asset market mirrored this downturn, with total capitalization slipping 1.04% to $3.68 trillion. Crypto analyst Ted highlighted Bitcoin's 6.5% post-FOMC drop, cautioning against excessive greed in current market conditions. Historical patterns suggest such corrections often precede new all-time highs, potentially signaling future upside once volatility subsides.

Market charts reveal Bitcoin's characteristic volatility pattern, with four separate 6-8% pullbacks occurring since mid-June. These periodic retracements have consistently formed part of Bitcoin's market structure, typically followed by robust recoveries. The current correction aligns with this established behavior, though the Fed's monetary policy stance adds unusual macroeconomic pressure.

Is It Too Late to Buy Bitcoin and Crypto in 2025?

Bitcoin reached a new all-time high of over $126,270 in early October 2025, fueled by record ETF inflows and growing institutional interest. The market's maturity, bolstered by regulatory clarity and political advocacy, contrasts sharply with its lingering volatility—evidenced by a historic $19B open interest wipeout in mid-October.

The question of whether it's 'too late' to invest misunderstands Bitcoin's evolution from speculative asset to macroeconomic hedge. Institutional adoption, including $5.95B weekly ETF inflows reported by Reuters, underscores its portfolio-strategic role rather than short-term trading potential.

While price swings persist—impacting 1.6M traders during October's correction—the broader narrative centers on accumulation, not timing. Fragile market structures coexist with irreversible adoption trends, making duration of exposure more critical than entry points.

Analysts Favor MicroStrategy (MSTR) Amid Bitcoin-Led Growth

MicroStrategy (MSTR) continues to draw bullish sentiment from Wall Street analysts following its Q3 earnings beat, driven largely by gains from its Bitcoin treasury holdings. BTIG analyst Andrew Harte maintained a Buy rating, trimming the price target to $630 from $700 while emphasizing long-term upside tied to Bitcoin's trajectory. The stock carries a consensus 127.83% implied upside among top analysts.

The business intelligence firm has become a proxy for institutional Bitcoin exposure, with its aggressive accumulation strategy under CEO Michael Saylor. Its performance remains tightly correlated with crypto market cycles—a double-edged sword that amplifies both gains and volatility.

Will BTC Price Hit 200000?

Based on current technical and fundamental analysis, reaching $200,000 represents a significant challenge in the immediate term but remains plausible in a longer-term bullish scenario. The current price of $109,284.47 would require approximately an 83% increase to achieve the $200,000 target.

| Current Price | Target Price | Required Gain | Timeframe Assessment |

|---|---|---|---|

| $109,284.47 | $200,000 | 83% | Medium to Long Term |

BTCC financial analyst Mia explains, 'While the $200K milestone is ambitious given current market conditions, the ongoing institutional transformation and Bitcoin's evolving role in global finance create a foundation for substantial long-term growth. However, investors should expect volatility and consider dollar-cost averaging strategies rather than timing the market.' Key factors that could drive this appreciation include accelerated institutional adoption, favorable regulatory developments, and macroeconomic conditions supporting digital asset growth.